This week, Retail Week published a feature about the current rental market, including quotes from our Founder Anna.

Instead of buying a record, we stream our music through Spotify. Rather than purchasing a car, many of us are content with relying on Zipcar for occasional road trips or booking a cab on Uber.

DVDs have been disregarded in favour of gorging boxsets on Netflix. As the sharing economy has boomed over the past decade, so too has consumers’ preference for renting over ownership.

This kind of behaviour is on an upward trajectory and is infiltrating many sectors, including furniture and clothing.

‚ÄúPart of the reason behind the slightly different model of consumption is that many households lead much more transient lifestyles,‚ÄĚ says Neil Saunders, managing director at GlobalData Retail. ‚ÄúThey move regularly and don‚Äôt necessarily want to buy stuff like furniture as it‚Äôs too much of a hassle to transport it when they change where they live.‚ÄĚ

Ikea’s rental experiment

Whether it’s down to our more transient nature, economic necessity or our desire to lead more environmentally friendly lifestyles, this shift in mindset is causing retailers to sit up and take notice.

Enter Ikea. Last month the retailer revealed plans to lease furniture, starting with office furniture such as desks and chairs to business customers in Switzerland, as part of a wider company strategy to create a fully circular business by 2030.

A spokeswoman for parent company Ingka Group says: ‚ÄúWe have an ambition to inspire and enable people to play an active role in making the circular economy a reality, which we can support by developing new ways for people to buy, care for and pass on products.‚ÄĚ

Ikea isn’t the only furniture retailer making inroads into this burgeoning space. This month West Elm revealed plans to partner with Rent the Runway, a clothing rental service in the US, to offer a selection of pillows, blankets and covers to rent to the site’s 10 million customers.

Launching this summer, customers will be able to choose how long they keep the product and receive a discounted rate if they decide to keep it.

Does this mean renting furniture will become the norm? Harth, a London-based website which launched last year and offers rentable furniture, home décor and art from brands, designers and artists, is hoping so.

‚ÄúAll around the world people are experiencing a similar feeling of having had enough of ‚Äėstuff‚Äô and coming to the realisation that owning things can weigh us down, both physically and mentally,‚ÄĚ says Harth co-founder Henrietta Thompson.

‚ÄúWe‚Äôre also getting worried about landfill and sweatshops and the growing population, among other things. We are starting to place real value in experiences, and renting gives us a lot more options there.‚ÄĚ

Thompson says customers come to Harth for a variety of reasons: it might be a practical solution for a short-term need; they might desire a major statement piece; or they simply fancy a seasonal refresh. But with most people accustomed to owning rather than renting furniture, how difficult is it to change consumers’ behaviour?

‚ÄúThe interiors industry is definitely a very slow-moving and traditional one, but it‚Äôs not completely immune to change,‚ÄĚ argues Thompson. ‚ÄúAlready we‚Äôre noticing that people are much more receptive to the concept than they were even just six months ago. And although our approach is still very unique there are more and more brands getting into this space now.‚ÄĚ

However, WGSN senior editor Petah Marian believes renting furniture requires a shift in attitude to really take off and also questions the practicality of multiple ownership. ‚ÄúThere‚Äôs the issue of what happens if an item is knocked around a bit. It‚Äôll require a change in how the product is made. It will need to be designed for longevity and durability.‚ÄĚ

Clothes rental

Of course, across some sectors, renting is nothing new. Men regularly hire suits and tuxedos for weddings, events and work, and over the past decade, we’ve seen a wave of online companies renting designer clothes to women.

This is a growth area. Allied Market Research predicts that the global online clothing rental market is set to jump from $1bn in 2017 to $1.9bn by 2023.

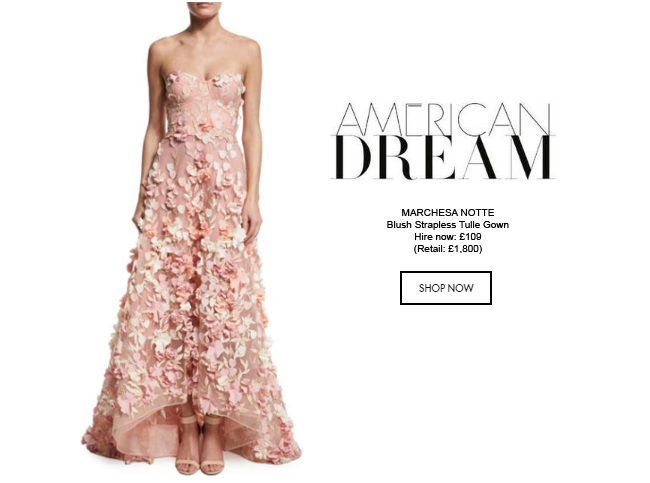

Anna Bance set up Girl Meets Dress, which offers access to 4,000 designer dresses and accessories from more than 200 designers for a fraction of the price, in 2009.

‚ÄúDesigner clothing is expensive and a notoriously poor long-term investment and it can lead to a wardrobe full of things you never wear but spent too much on to give away en masse,‚ÄĚ says Bance.

‚ÄúThe topic of fashion sustainability is increasingly in the headlines. People are becoming more ethically aware of their environmental footprint. But Girl Meets Dress made it accessible and sustainable.‚ÄĚ

But what does it mean for the brands which potentially lose a customer spending at least five times as much at full price?

Bance argues that brands view Girl Meets Dress as ‚Äúone of their biggest allies‚ÄĚ as they‚Äôre introducing them to a new customer. ‚Äú90% of our customers are trying a brand for the first time when they rent with Girl Meets Dress.

‚ÄúThey start renting ¬£900 dresses and they develop that brand affinity early. We hook them.‚ÄĮ We also get approached by lots of smaller new brands, launching a collection and wanting the feedback.‚ÄĚ

Alibaba certainly thinks clothing rental is the future. The online giant has invested in Chinese clothing sharing platform Ycloset and US market leader Rent the Runway.

Rent the Runway was founded in 2009 and today has 10 million members and five physical stores. Last year it turned over $100m and is valued at $800m.

Rent the Runway chief revenue officer Anushka Salinas says: ‚ÄúWhen Rent The Runway launched, we were in the business of helping women get dressed for the most important special occasions in their lives, like weddings, formal events, baby showers ‚Äď events that would happen around five times a year. Now, our most engaged subscriber is wearing a rental 120 days a year.

‚ÄúRental has shifted from being a convenient solution for special events to a true utility changing the way she gets dressed every day.‚ÄĚ

To make the process of renting even more convenient, last autumn the retailer launched standalone drop-off boxes across the lobbies of 15 WeWork spaces.

Salinas believes that in the future up to 80% of the wardrobe will be owned while the rest will be rented. ‚ÄúWe want our customer to purchase their wardrobe staples like a leather jacket, white button-down shirt and trusted flats from our brand partners and rent the trendy, bold and patterned pieces from us,‚ÄĚ she says. ‚ÄúThis allows women to experience the endless variety they crave, without the need to buy items they will wear only once or twice.‚ÄĚ

Can rental work at lower price points?

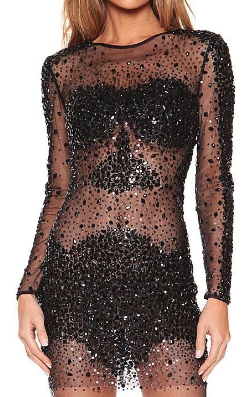

If the future is rental, how will that impact retailers? Some are keen to dive in. Young fashion retailer Little Mistress plans to launch a renting service by the end of the year.

‚ÄúIt‚Äôll be a VIP range featuring red-carpet-style garments with a price tag of ¬£300-plus for a ¬£50 hire fee,‚ÄĚ says Mark Ashton, founder and chief executive of Little Mistress Group. Is he concerned that it may cannibalise sales?

‚ÄúIt‚Äôs a different proposition,‚ÄĚ he says, pointing to the fact that products are of higher value. ‚ÄúAnd if it impacts sales then so be it, but I do believe this customer will hire up to six to eight times per year where she would have only bought one to two dresses over the same period. In time it will prove profitable in many areas and will breed returning customers.‚ÄĚ

While Ashton is targeting a more high-end market, analysts are unconvinced that rental will work across lower price points.¬†‚ÄúPeople want to rent more of an expensive item,‚ÄĚ Marian says. ‚ÄúI could see it working at Whistles level, for instance, but whether it would work at lower high street level I‚Äôm not sure it would be cost effective.‚ÄĚ

Saunders believes that renting works best across two areas. First, categories where people only want to use a product for a limited amount of time and so don‚Äôt want to commit to buying it. ‚ÄúThis means products like DIY tools, high-end clothing, jewellery and such are all prime candidates for rental,‚ÄĚ he explains.

‚ÄúSecondly, big-ticket items that people don‚Äôt want to buy outright because of the expense or because they don‚Äôt need them for the long term. This means areas like furniture will probably see more renting over the next few years. What works less well is everyday items like basic apparel or simple homewares.‚ÄĚ

Still, Saunders is cautious about retailers throwing themselves into this new burgeoning area. ‚ÄúA lot of retailers are jumping on the rental bandwagon because of the growth,‚ÄĚ he says. ‚ÄúSome will have success but others ‚Äď mainly those that aren‚Äôt in sectors where renting is really needed ‚Äď will fare less well.‚ÄĚ

Rental needs to be carefully managed, he says. “If it helps a retailer expand their customer reach by drawing in new segments, then it is valuable. If it simply cannibalises non-rental sales from existing customers, then it is dilutive to margins and profits. Volumes could also be undermined, which would impact economies of scale and profits.

‚ÄúWe see some retailers like American Eagle and Ikea getting into the game and you have to question how the economies of scale will stack up. Admittedly, renting is only going to be a very small part of their business for a while, but if it starts to grow and become bigger then it will arguably become problematic.‚ÄĚ

But retailers should be prepared for change. As Bance says: ‚ÄúSomething in traditional retail needs to change. Clearing the shops every three months and telling consumers that trends are changing and you need to buy something new isn‚Äôt sustainable.‚ÄĚ

Designer A-Z

Designer A-Z